HM Land Registry recently announced a new standard for the use of digital due diligence, which they have called Safe Harbour.

Safe Harbour is designed to encourage the use of digital processes when completing due diligence as part of the conveyancing process and to lift the standards and robustness of existing digital due diligence.

What is the Safe Harbour Standard?

HM Land Registry requires legal professionals dealing with the disposal and/or acquisition of property/land, where the professional is using identity verification technology rather than seeing the original documents, to meet the Safe Harbour standard. Safe Harbour solely relates to the identity verification process and does not relate to anti-money laundering checks like PEPs/Sanction.

Conveyancers who complete their customer due diligence and meet the Safe Harbour standard are effectively indemnified from any further action should it later transpire that the end-user was acting fraudulently.

What are the requirements and how can Credas help?

Requirement 1 ‘Obtain evidence’

You must find out if the person you are representing is who they say they are by using a form of evidence that can be checked by interrogating cryptographic security features.

Security features must include an electronically held photo of the identity against which biometric facial recognition checks may be made e.g.

- Biometric passports that meet the ICAP specifications for e-passports.

- Identity cards from an EU or EEA country*

- UK biometric residence permit.

Requirement 2 ‘Check the evidence’

Check the evidence obtained to ensure it is a genuine document that has not be forged and is in date. This must be done by reading the chip within the evidence using NFC.

Requirement 3 ‘Match the evidence to the identity.’

Check that the person presenting the information matches the photo on the ID document and verify with a ‘liveness check’

Requirement 4 ‘Obtain evidence to ensure the transferor, borrower or lessor is the same person or entity as the owner.’

The conveyancer must connect the individual to the property by obtaining evidence and checking the name and address matches that of the individual claiming the identity match

Are Credas checks Safe Harbour compliant?

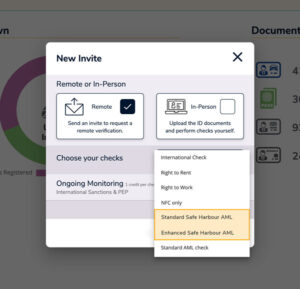

Credas already offers users of our service the ability to meet the new Safe Harbour standard, but to make the process simple, smooth and slick, today we are announcing the addition of two new ‘Safe Harbour Journeys’ to our service.

These two new customer journeys will encourage and guide the end-user through the process to ensure they meet the Safe Harbour standard, removing any complexity for both our customer and their client.

Safe Harbour ID checks FAQS

Why then should conveyancers insist on a Safe Harbour check – what makes it so important?

Safe Harbour is only important to conveyancers where identity verification technology is used. If you verify an identity in the “traditional” way (e.g. in person with original documents), Safe Harbour is irrelevant. However, if you use technology, you will want to insist on the Safe Harbour standard being met as it is your only protection against action from HM Land Registry if it transpires that the verified identity was false.

Is property fraud really that big a problem?

Yes. HM Land Registry recorded 46 cases of attempted property fraud in 2021/22 compared to 25 cases in 2017/18; an increase of 84% in 5 years. Although 46 cases may not sound many when compared to the number of property transactions, the 46 represented more than £31m in value. Additionally, it is believed that property fraud is the most prevalent type of fraud, with 51.1% of detected/prevented fraud being housing fraud.

Isn’t my existing way of doing remote ID checks through teams or WhatsApp sufficient?

No. Regulations and the SRA require that original documents be used when verifying someone’s identity. Even with identity verification technology, the original document must be present; uploads of existing scans/photos cannot be used.

What if my client doesn’t have an ePassport?

Unfortunately, if the individual does not have an ePassport, you will be unable to satisfy the Safe Harbour standard. You are, however, able to satisfy Regulations and the SRA using a passport that contains no biometric chip.

How does Safe Harbour checks work for International Clients?

There is no difference for domestic or international clients. Many countries now issue ePassports and therefore the Standard can be achieved. One thing to remember, when dealing with a vendor based overseas, is that whilst you will want to obtain proof of residence for them (overseas address) you will still need 2 documents linking them to the property being sold (in the UK).

Do I need to have specific T&Cs when conducting a Safe Harbour check?

UK GDPR/Data Protection legislation requires organisations be transparent with their customers as to how their data is used and with whom it is shared. Therefore, it is prudent to include text in your terms of business which states you are required to carry out identity verification. It might also be useful to include a line such as “you may be asked to do this using one of our trusted providers”, however this is not a requirement. Your privacy notice should confirm that where their identity is being verified using technology, their personal data will be shared with trusted third parties.